In November 2023, the U.S. Department of Labor released its package of proposed changes to the regulation defining fiduciary advice and to the exemptions for conflicts and compensation for investment recommendations to retirement plans, participants (including rollovers), and IRAs (including transfers). On March 8, 2024, the DOL sent the final rule to the Office of Management and Budget in the White House.

Key Takeaways

- In a little over 2 months, the DOL finalized it proposed fiduciary rules—the Retirement Security Rule: Definition of an Investment Advice Fiduciary.

- That 2-month turnaround is very fast as compared to the usual time frames, suggesting that the OMB review may also move quickly.

- The OMB has up to 90 days to review rules, but this suggests that its review could be done in 45 days, give a week or two.

- While we know that the final rule is at the OMB, we don’t know what it says or how it changed from the proposals. We will only know that after it is published in the Federal Register when the OMB review is completed.

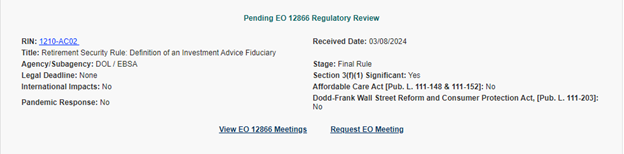

The Department of Labor has sent its final versions of the fiduciary proposal to the White House’s Office of Management and Budget (OMB) for review. While the OMB’s website just refers to the “Retirement Security Rule: Definition of an Investment Fiduciary”—the name of the fiduciary regulation—it is likely that the rules sent for regulatory review included the prohibited transaction exemptions as well. The RIN (1212-AC02) for the final rule is the same one in the Regulatory Agenda that included the exemptions.

This starts the clock on the review of the regulation and the exemptions by the OMB. While the OMB has up to 90 days to review rules, The speed with which the DOL finished the regulation and exemptions suggests that this is on a fast track. That could mean that the final rules will be approved within 30-60 days. Once the OMB completes its review, the DOL will publish the rules in the Federal Register and we will be able to see the changes from the proposals. But for now, all we know is what is posted on the OMB website, which is:

Once the final regulation and exemptions are published in the Federal Register, they will become “effective” 60 days later. So, for example, if they are released by the OMB and published in, say, late April, they will be effective in late June. In that case, they may be subject to the Congressional Review Act (CRA) by this Congress, and not the next. The significance is that, with a Democratic Senate and President, there is virtually no chance that the rules would be overturned. However, if after the November elections, the Republicans gain control both Houses of Congress and the White House, the CRA could be used to invalidate the rules. My suspicion is that someone is watching the “clock”.

But “effective” isn’t necessarily the same as “applicable.” In my estimation, it is likely that the rules will be applicable no earlier than January 1, 2025. However, it is possible that they will be applicable on the effective date. If so, there would have to be some extended compliance period (e.g., good faith) because it will be impossible for independent insurance agents and the insurance selling through them to be in full compliance that quickly. While the rules will impact broker-dealers, investment advisers, and banks and trust companies, the changes are relatively minor for those that were in compliance with PTE 2020-02 . . . and particularly for those who did not stop complying after the Florida Federal District Court decision overturning the PTE’s “regular basis” fiduciary interpretation. On the other hand, the new PTE 84-24, as proposed for independent insurance agents, requires an entirely new compliance structure and process.

Once the final rules are published in the Federal Register, there will almost certainly be lawsuits challenging them. In all likelihood, the plaintiffs will file with a Federal District Court in the 5th Circuit (covering Texas, Louisans and Mississippi) because they will be “forum shopping” for a conservative judge and the ability to appeal to the most conservative appellate court—the Fifth Circuit Court of Appeals. It was the Fifth Circuit that struck down the Obama-era fiduciary regulation.

However, by the time the Fifth Circuit had struck down that rule, Obama had left office and Trump had taken over. As a result, the DOL did not ask the Fifth Circuit to consider the ruling en banc nor did it ask the Supreme Court to consider the Fifth Circuit’s holding. In effect, the government dropped the case. This time the circumstances are eerily similar. Any appeals will be heard after the winner of this year’s Presidential election. If the Democrats keep control of the White House, the case could go all the way to the Supreme Court. If the Republicans win, they may drop the case if the final rules are overturned by a trial court or the appellate court. But they could ask for Supreme Court review if the rules are upheld. In a nutshell, a Democratic President will likely support the fiduciary standard, while a Republican President would likely support overturning the fiduciary standard.

Concluding thoughts

But, those are only “best guesses.” As Yogi Berra purportedly said, “It’s tough to make predictions, especially about the future.”

We will know soon enough—in 60 days or less—about the rules. The elections are a little further away. And the outcome of the lawsuits is even further down the line. It is possible, perhaps even likely, that the rules will become applicable on January 1, but the outcome of the lawsuits won’t be known for years from now.

The material contained in this communication is informational, general in nature and does not constitute legal advice. The material contained in this communication should not be relied upon or used without consulting a lawyer to consider your specific circumstances. This communication was published on the date specified and may not include any changes in the topics, laws, rules or regulations covered. Receipt of this communication does not establish an attorney-client relationship. In some jurisdictions, this communication may be considered attorney advertising.

To automatically receive these articles in your inbox, simply SIGN UP for a subscription and new articles will be emailed to you.

The views expressed in this article are the views of Fred Reish, and do not necessarily reflect the views of Faegre Drinker.